Trading Got You Stressed? Imagine an AI Super-Coach!

Let's face it, trading can be a wild, emotional rollercoaster. One minute you're up, the next you're wondering what just happened. The market's chaotic dance, the flashing numbers, the constant stream of news – it's enough to make anyone's head spin. What if you had a brilliant, emotionless co-pilot guiding your every move, whispering sage advice gleaned from mountains of data?

Enter AI trading mentors – not just automated trading bots executing pre-programmed commands, but smart, AI-driven platforms designed to make you a smarter, more confident trader. Imagine a digital sensei or AI trading companion, patiently analyzing your every move, pointing out patterns you'd never see yourself.

We're diving deep into what these digital gurus are, where they came from (hint: it's a longer journey than you might think), the good, the bad, the ugly, and a peek into their future – plus how an app like Plancana is leading the charge, not by replacing human intuition, but by augmenting it.

From Punch Cards to Predictive Power: A Brief History of AI in Finance

The notion of applying computational power to finance isn't new. The story begins decades ago, shrouded in the mists of technological antiquity.

- The Early Days (70s-80s): Think basic "if-then" algorithms, lines of code dictating actions based on simple conditions. Algorithmic trading started as simple rule-following, like a robot buying if the price hits X. "Expert Systems" tried to mimic human knowledge, attempting to codify the wisdom of seasoned traders, but were ultimately clunky and brittle. Early expert systems often struggled with unforeseen market conditions because of their limited ability to learn from new data.

- The Rise of the Machines (90s-2000s): Computational power exploded, and so did data! Machine Learning (ML) snuck into fraud detection, credit scoring, and eventually, High-Frequency Trading (HFT) – think lightning-fast trades, thousands per second. These systems leveraged increasing computational power to quickly analyze large datasets, identifying patterns and executing trades at speeds that human traders couldn't match.

- Today's Revolution (2010s-2020s): Deep Learning, Generative AI (like ChatGPT), and Large Language Models (LLMs) changed everything. Now AI can understand and generate human-like insights, paving the way for personalized mentorship. It's not just about speed anymore, it's about smarts. AI systems can now process and interpret complex financial news, analyze sentiment, and generate personalized trading recommendations.

Your New Best Trading Buddy: What AI Mentors Do (and Why Everyone's Talking About Them)

So, what is an AI Trading Mentor? Forget images of Skynet managing your portfolio. It's your personal, digital coach, partner, and AI trading companion. Their main gig? To empower you to learn, master, and make confident, independent trading decisions. They're not here to trade for you, but to teach you to fish! The goal is not to replace traders, but to augment their abilities and provide them with the tools and knowledge to make better decisions.

Superpowers on Demand (Key Features):

- Real-time Market Analysis: Sifting through global news and data faster than a human could blink, giving you actionable insights. Imagine having a tireless analyst constantly scanning headlines, economic reports, and social media feeds, all to give you a comprehensive overview of the market landscape.

- Personalized Performance Review: Ever wonder why you keep making that one mistake? AI analyzes your trading history, pinpointing strengths and, yep, those pesky weaknesses you can't see yourself. This is where the "mentor" aspect shines: identifying patterns in your trading behavior that lead to both successes and failures.

- Tailored Education: Learning material that adapts to your level and needs. No more slogging through irrelevant lessons! Adaptive learning ensures that you're constantly challenged and engaged, receiving the right information at the right time.

- Risk Management Guru: Helping you set up smart safeguards so you don't accidentally bet the farm. Setting stop-loss orders, diversification strategies, and position sizing are all crucial aspects of risk management that AI can help you master.

- Emotional Support (Sort Of): Identifying behavioral patterns like emotional trading or overtrading, offering prompts and nudges to build a stronger mindset. This is a subtle but powerful feature, recognizing that emotions can significantly impact trading performance.

Why Traders are Loving Them (The Pros!):

- Efficiency & Accuracy: Data processing that would make your head spin – in seconds!

- Emotion-Free Decisions: No fear, no greed, just data.

- 24/7 Vigilance: Markets never sleep, and neither does your AI mentor.

- Personalized Growth: It's like having a bespoke trading curriculum just for you.

Hold Up! The Dark Side of the Digital Guru (Controversies & Cons)

But before you dive headfirst into the world of AI trading mentors, let's pump the brakes for a moment. Like any powerful tool, these systems come with their own set of caveats and potential pitfalls.

- The "Black Box" Problem: Sometimes, AI makes decisions, but how? Its logic can be opaque, making it hard to trust or fix errors. This lack of transparency can be unsettling, especially when dealing with your hard-earned money.

- Bias, Bias, Everywhere: AI learns from data. If the data is biased (e.g., favors certain demographics or market conditions), so will the AI's advice. This can create an unfair playing field. Historical market data may reflect past biases, leading the AI to perpetuate those biases in its recommendations.

- The Risk of Over-Reliance: It's easy to get lazy. Relying too much on AI can dull your own judgment and analysis. Plus, AI can "hallucinate" incorrect info, especially in complex scenarios. The technology is a tool, and should not replace critical thinking or independent analysis.

- Market Manipulation Worries: With ultra-fast HFT, there's always a lurking fear of AI systems inadvertently (or intentionally) destabilizing markets or engaging in manipulative tactics. The speed and scale of AI-driven trading could potentially amplify market volatility and create unintended consequences.

- No Human Touch: AI can't give you a pep talk when you've had a bad day, or truly understand nuanced, personal financial situations. Trading is not just about numbers; it's also about psychology and emotional resilience.

- Cost & Access: Top-tier AI tools can be expensive, potentially creating a "digital divide" for smaller traders.

- Regulatory Catch-Up: The tech moves fast, regulations often lag, leading to a murky ethical and legal landscape.

Plancana to the Rescue! Your Mindful AI Trading Sidekick

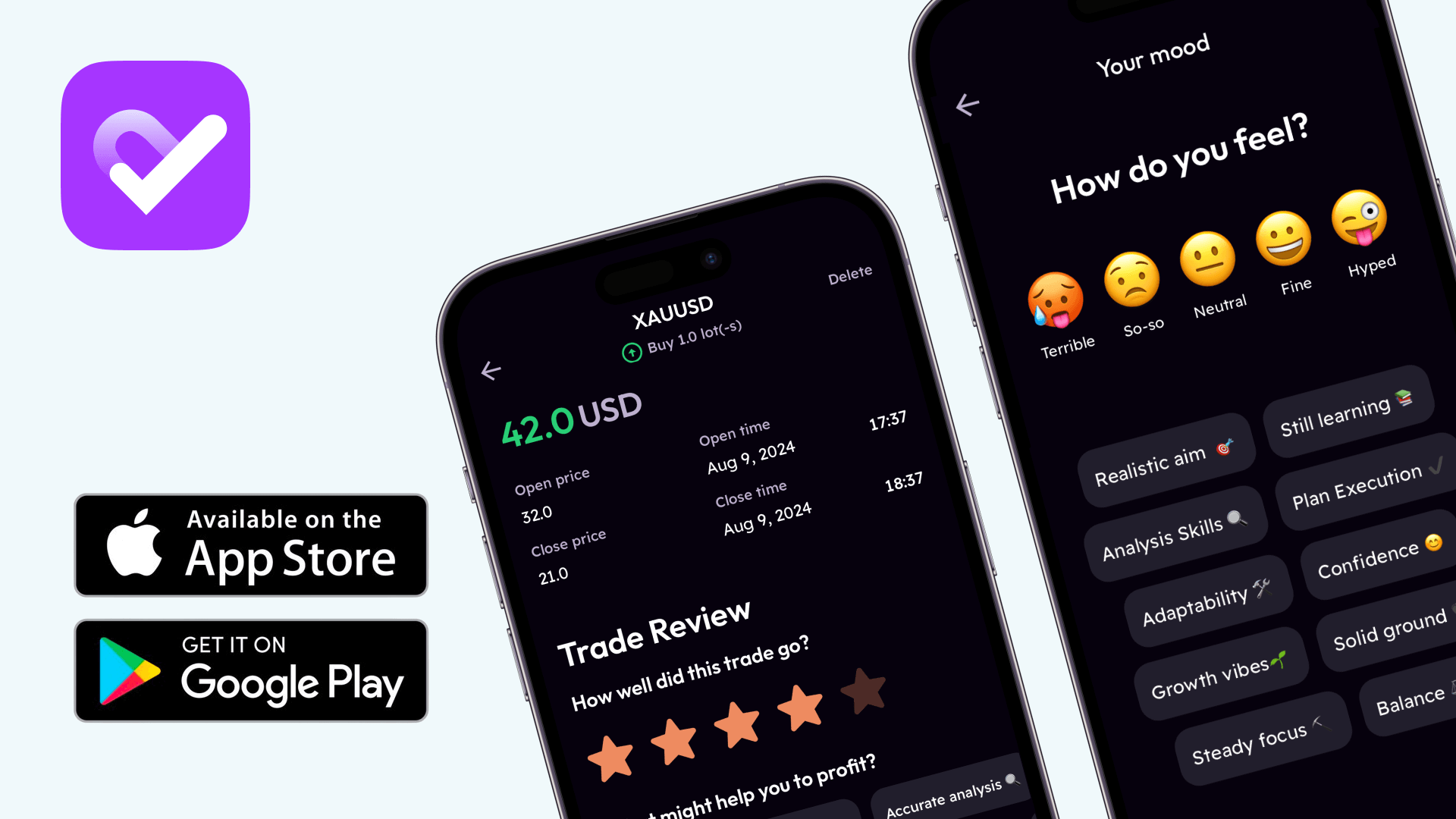

Enter Plancana. This isn't just another trading app; it's an AI-powered trading journal and AI trading companion designed to make you a better, more disciplined trader across forex, crypto, and stocks. It recognizes that successful trading is not just about algorithms and data, but also about self-awareness and emotional control.

Plancana's AI Superpowers:

- Personalized Plan Generator: Forget generic strategies! Plancana's AI crafts unique trading plans tailored to your goals, risk tolerance, and style. Daily targets, risk-reward ratios, drawdown limits – it's all custom-made for you.

- AI-Driven Insights, Sans Judgment: The AI sifts through your trades and journal entries, giving you unbiased feedback in plain English. It highlights your growth areas so you can actually learn from your mistakes.

- The Mood Whisperer: This is a game-changer! Plancana's unique mood diary helps you track your emotional state with each trade. The AI then analyzes how your mood impacts your outcomes, helping you identify triggers and build emotional stability – bye-bye revenge trading!

- Deep-Dive Performance Analytics: Win/loss ratios, expectancy, drawdown, profitability heatmaps – Plancana's AI turns your raw data into clear insights about what makes you profitable (or not).

- Automated Logging: Integrates with platforms like MetaTrader 5, so your trades are logged automatically. Less busywork, more strategy!

How Plancana tackles the cons: It encourages your independent decision-making, directly addresses emotional biases, and provides structure without turning you into a robot. It's about self-awareness and growth, powered by AI.

The Road Ahead: What's Next for Your AI Trading Mentor?

The evolution of AI trading mentors is far from over. Expect to see even more sophisticated and integrated tools in the years to come.

- Hyper-Personalized Learning: Expect even more bespoke educational content, quizzes, and mock trades that adapt to your every nuance.

- Real-time, Contextual Coaching: Imagine your AI flagging an unusual pattern during a live trade, explaining why, and suggesting an indicator – turning every moment into a learning op.

- Smarter, More Transparent LLMs: Generative AI will get even better at explaining complex financial concepts and market dynamics, even opening up the "black box" with "Explainable AI" (XAI).

- Next-Level Risk & Behavioral Coaching: More integrated tools like journaling prompts and emotional check-ins to build bulletproof trading discipline.

- Hybrid Mentorship Models: Combining AI's analytical power with the nuanced advice and emotional support of human mentors.

- Wider Reach, Deeper Integration: AI tools becoming even more affordable and seamlessly integrated into all your trading platforms, leveling the playing field for everyone.

The Final Verdict: Is an AI Mentor Your Future Trading Edge?

In conclusion, AI trading mentor offer incredible potential for efficiency, personalized learning, and emotional discipline. But they come with their own set of challenges, from biases to over-reliance.

The smart approach is to recognize that AI isn't here to replace you, but to empower you. Think of it as a powerful co-pilot or a brilliant tutor, not a fully autonomous driver. The human element remains crucial: your intuition, your understanding of market psychology, and your ability to adapt to unforeseen events.

Ready to Level Up? Tools like Plancana show us the future is bright for traders who embrace intelligent assistance. By combining cutting-edge AI with a focus on your growth and mindful trading, you can truly supercharge your journey from novice to trading master. What are you waiting for? Your future trading self will thank you!